Content

The newest FDIC’s details indicate that you haven’t yet , advertised your deposit insurance policies consider, because of the cashing the brand new consider or from the transferring they to the a merchant account during the a good depository establishment. And remember one FDIC deposit insurance coverage just enforce whenever an excellent lender fails. The new FDIC guarantees places depending on the possession group in which the cash is actually insured and exactly how the fresh account try named. If you need the fund covered by the FDIC, only place your financing inside the a deposit account in the an enthusiastic FDIC-covered financial and make sure that your deposit will not exceed the insurance coverage limitation for the ownership category.

- Really deposit glides have an extra set of boxes printed on the the back which means you wear’t must fill out your own personal advice many times and deal with several subtotals.

- Depositors is term as numerous beneficiaries because they wish to, nevertheless visibility limitation doesn’t exceed $step one,250,100 as of April 1, 2024, long lasting readiness day or perhaps the day the fresh Computer game are bought.

- We are going to replace currency sales that will be bad otherwise damaged.

- From the sticking with these pointers, banking companies is also make sure customers’ deposits is actually handled carefully and you will are not missing.

John Jones features $30,100 uninsured since the their total balance are $step one,280,one hundred thousand, and this exceeds the insurance limit because of the $31,000. The fresh FDIC assumes on that co-owners’ shares are equivalent except if the new deposit account info condition if not. The brand new FDIC guarantees deposits belonging to a best proprietorship since the a good Unmarried Membership of the entrepreneur. If an account name means only one manager, however, someone gets the directly to withdraw funds from the newest account (elizabeth.grams., because the Strength of Attorney or caretaker), the brand new FDIC usually ensure the fresh account since the a single Account.

If my lender goes wrong, how come the new FDIC manage my personal money? – 100 free spins no deposit samba carnival

It may cause a lot of misunderstandings and you can fears, leading to a loss in trust in the new bank’s ability to deal with their customers’ cash. Full, tech options is going to be an invaluable tool for managing misplaced deposits. At the same time, of a lot cellular put options render real-date deposit condition status, helping consumers to track their places always. Various other trick advantageous asset of technology options is because they might help teams so you can quickly and easily care for points when misplaced places create are present.

Availability your tax suggestions with an enthusiastic Irs account.

The fresh FDIC ensures 100 free spins no deposit samba carnival up to $250,000 per depositor, for each FDIC-insured financial, for each possession class (such solitary otherwise joint accounts). Generally, financial institutions will simply expect you’ll tune in to away from Computer game holders when a Cd grows up, because the that’s the chance to create withdrawals, dumps, or other changes on the membership. Alternatively, when you use an online financial, you are capable deposit the cash from the a vintage bank and transfer the funds into your online bank account.

But not, FDIC put insurance is limited for money to the deposit in the an enthusiastic FDIC-insured bank. FDIC deposit insurance rates handles your covered deposits if the financial closes. When you have a few unmarried possession membership (such as a bank account and you will a checking account) and one old age account (IRA) in one FDIC-insured bank, then you will be insured as much as $250,100000 to the shared equilibrium of the finance regarding the a couple of solitary control account. FDIC put insurance coverage talks about $250,100000 per depositor, for each and every FDIC-insured financial, for each and every membership possession group. FDIC put insurance policies only covers places, and only in case your financial try FDIC-insured.

I did worry at first, however, assumed they might number the cash on the servers and you will care for the problem. They performed provide my personal debit cards back, however, don’t give any number of one’s cash one ran to the machine. Know how to build healthy economic designs today to set the college students right up for higher achievement later. The brand new annuity brings guaranteed installment payments that have a more impressive full payout over day, while the cash choice will provide you with immediate access to extreme sum which can be invested right away. They could walk you through commission choices and you will, in some claims, let create a rely on which allows you to definitely claim the fresh award anonymously. It’s preferable to secure the information inside an incredibly quick network of top members of the family.

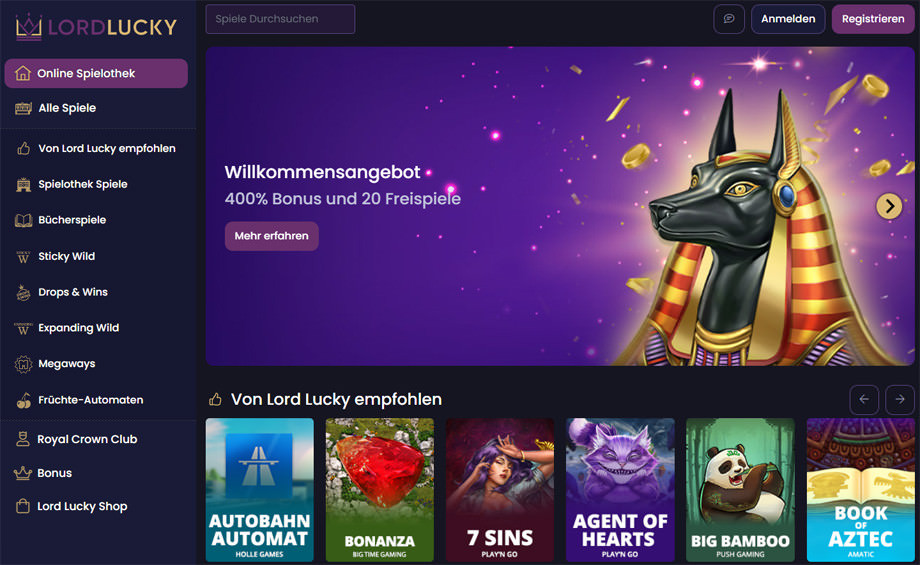

Depending on the casino and the payment approach you choose, your a real income withdrawal will likely be processed within 2 days. But understand that to stop becoming with your own money, casinos will normally impose a limit on the payouts you could cash out. When you’ve satisfied all extra conditions, you might request a detachment. Best pick a package one claimed’t hurry you together with your 100 percent free loans. The newest stipulated number and time period within which to complete the fresh added bonus can vary away from 0x to 60x or higher. Don’t rush to your getting a flashy $one hundred incentive – big isn’t usually finest.

Do you realize… Loved ones usually is actually unaware it’re eligible to gather unclaimed bucks, refunds and you may benefits due dead loved ones just who passed away instead of an enthusiastic updated tend to. Comment your bank account arrangement for rules specific to the lender and you will your bank account. If you withdraw money inside the very first half a dozen months after put, the newest punishment was at least seven days’ easy focus. Now the owner is trying to put the duty to the you to restore the fresh forgotten cashiers take a look at. Should your Atm is belonging to anyone aside from a financial otherwise credit relationship, it is still important to let your lender know basic.

She approved, but has while the gone the the girl accounts to some other financial. He says firms accountable for exploring problems lack freedom away from financial institutions as there are no dependence on financial institutions to react to help you issues easily otherwise pay money that is forgotten. While you are quarantined at home, it’s prime time doing certain financial “spring-cleaning” and make certain all of your financial programs don’t have money resting included. This type of software are ideal for sharing money and splitting the balance for takeout, however it is best that you transfer that cash to your family savings.

Such, for individuals who’lso are a card connection associate playing with another credit relationship’s part (through mutual branching), you’ll have to write in the name of your own “home” borrowing from the bank union. The whole process of filling out deposit slides varies based on exactly what you’re also performing. Teaching themselves to correctly complete a deposit slip can save some time and prevent mistakes. Deposit glides choose both you and offer tips to the lender. Both offer speaking-to Reuters explained it a method one ex boyfriend-Ceo Bankman-Deep-fried could make transform for the business’s statement of finance instead of flagging the transaction possibly internally otherwise externally. The newest monetary finding procedure as well as unearthed a great “back-door” inside the FTX’s guides that was created with “bespoke app.”

Red, Bluish, & Reddish Postal Currency Acquisition (March

We cashed my personal certificate away from put (CD) before it mature, plus the lender charged myself an early detachment penalty. Very my personal savings account is determined in order to text me personally as i receive a deposit otherwise has a great withdraw that’s more than $100. We (my wife and i) had a cashiers look for a security put to your a flat. And, if your situation happened out of condition otherwise with an account that’s less than 30 days old, banking companies may take extra time.

Places managed in different kinds of legal control at the same bank will be on their own covered. Deposits inside separate branches of an insured financial aren’t independently insured. A covered bank need to monitor an official FDIC signal at each and every teller windows.